The Ultimate Guide to Hedger Pro's 17 Free Systems

Comprehensive Insights into 17 Free Systems, Strategic Combinations, and Smart Staking for Informed Betting Decisions.

Hi Everyone,

With the exciting arrival of 17 new free example systems for our Hedger Pro members, I wanted to provide an in-depth exploration of each one. This post will go beyond a simple overview, delving into the nuances of each system.

We'll also explore potential strategies for combining these systems, whether running them all concurrently or selecting a curated portfolio with various staking approaches.

So, grab your favourite brew and settle in – this is a comprehensive guide!

(If there's anything I've overlooked, please don't hesitate to ask in the comments below or reach out via email at ryan@hedgerpro.co.uk)

Not a Hedger Pro member yet? Discover the edge at www.hedgerpro.co.uk

Let's begin by taking a detailed look at each of the 17 free example betting systems now available.

These systems are provided for all members and can be used immediately upon import.

However, I strongly recommend considering modifications to potentially enhance their performance. There's often scope to refine filters, broaden the selection range, and adjust settings to create your own unique strategies and avoid any potential market saturation.

I know we have many experienced system creators within our membership who may not directly utilize these examples, but I hope they can serve as a useful benchmark or perhaps even spark new insights into the capabilities of Hedger Pro.

For our newer members who are looking to start building their own systems, these examples are intentionally designed to be clear and practical illustrations of what's possible, and of course can be used in any combination right out the box.

Our assessment will start by examining the 17 imported systems from the top of the list, looking at their performance over the past four years or so, as well as focusing on more recent performance trends.

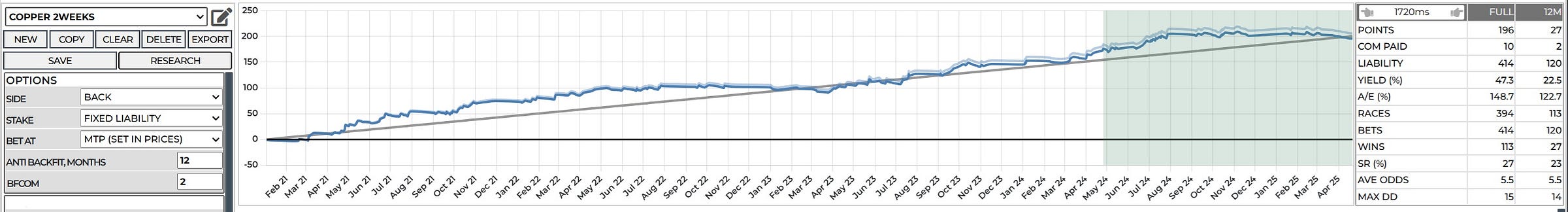

COPPER 2WEEKS

This system, expertly crafted by our valued Hedger Pro development team member, Alan, presents an interesting cyclical performance pattern.

The graph reveals a recurring trend of growth followed by a dip, and then another phase of growth. Ideally, we're poised to enter the upward swing of the next growth cycle.

While there might be a slight downward drift remaining before the anticipated trend reversal, historical comparisons with the line of best fit suggest any further dip should be minimal.

In fact, our current position mirrors where we were at this time last year, just before an upward trend commenced. My assessment indicates we might dip slightly below the best fit for perhaps another month before experiencing renewed growth.

Although the bet volume for this system isn't high, it boasts an attractive strike rate, low drawdown, and a respectable yield percentage.

Considering it's not a system with daily betting activity, the overall points accumulation is commendable.

The filter stack employed in this system is notably detailed, reflecting significant effort in identifying its underlying betting trend – a fascinating aspect for those who delve into system mechanics (members can explore these filters directly within Hedger Pro).

In my view, "COPPER 2WEEKS" is a valuable addition to a portfolio seeking a higher strike rate and low drawdown. It offers a more selective approach with betting opportunities occurring periodically throughout the year.

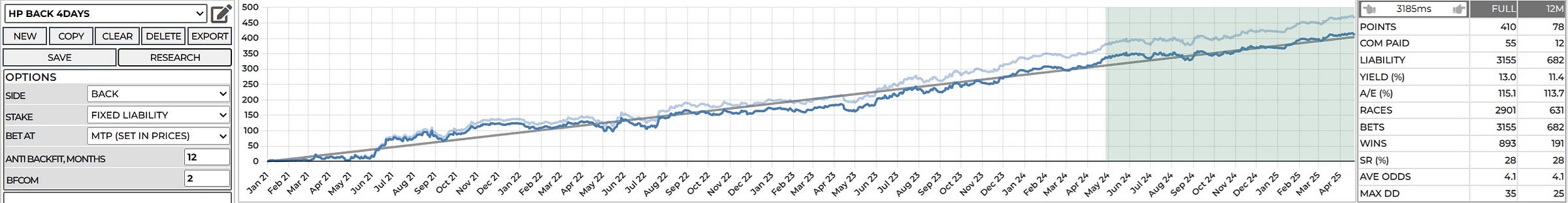

HP BACK 4DAYS

As the name suggests, this is a backing system active four days a week: Monday, Tuesday, Friday, and Saturday. This system is one of mine, created to provide a transparent example for Hedger Pro members.

It employs straightforward filters, targeting the top two horses in the betting market within a specific odds range, precisely three minutes before the race.

It operates exclusively on Turf within a defined range of runners. These basic filters aim to provide a realistic picture of the system's potential. My approach to building systems is always forward-looking, focusing on the initial concept and using Hedger Pro to validate its viability.

The overall performance over the past 52 months has been good, yielding an average annual points profit of 94.62. While the last 12 months have seen a slightly lower return, we're not far off this average. Importantly, the maximum drawdown for the system has not occurred during this recent 12-month period, which is a positive indicator.

A Closer Look: Betting System Assessment with HP BACK 4DAYS

Let's use this system to illustrate how to effectively assess a betting system's performance beyond just the final profit figure.

The growth of "HP BACK 4DAYS" isn't a smooth, upward line. It experiences periods of losing runs followed by growth phases that ultimately drive the overall results in the right direction.

This inherent ebb and flow is a reality of betting, and combining such systems within a portfolio helps to balance out individual periods of underperformance.

Looking at the graph, the system had a challenging start from January to June 2021. It then experienced a strong upward trend until January 2022, ultimately breaking even at around +138 points over this extended period.

Reaching this profit level wasn't a straightforward climb, highlighting the patience and long-term investment mindset required for automated betting.

It's important to note that these results are based on a 1-point stake per bet.

In the first year, there were approximately five months with no profit, including a notable period between August and September 2021 where the system either reached or came very close to its maximum drawdown. This occurred before it progressed to the +138 points profit.

While I won't dwell on this, the results and statistics clearly illustrate the potential betting patterns you might encounter. Conducting your own due diligence and thoroughly examining this history is crucial before deciding which systems to include in your portfolio.

Investing just a few minutes to assess a system's performance graph and history, whether it's one you've created or one we provide, can save you significant anxiety during inevitable losing periods.

Understanding that these patterns have occurred before can prevent unnecessary concern when your balance dips.

Simply focusing on the final points and statistics isn't enough. To gain a comprehensive understanding, I urge you to spend time exploring the information available within the Research tool. This will equip you with a realistic perspective on your investment and ensure you bet within your comfort limits.

Returning to the graph assessment for "HP BACK 4DAYS," we see a significant upward trend commencing around mid-July 2022, surpassing its previous high.

However, this period also shows three notable drop-offs, where substantial accumulated profit was lost, with the balance dipping to around 125 points from a high of 159.

Navigating this period would have required considerable resilience. From July 2022 to April 2023, the system then climbed to approximately +214 points profit.

Overall, from January 2021 to April 2023, the average points profit for this system stands at 91.71, with the maximum recorded drawdown of -35 points.

Crucially, this maximum drawdown figure may have been reached only once, but we would have been close to it or thereabouts on at least four occasions.

For long-term bettors utilizing automation, understanding these potential drawdown periods is vital.

While the average points growth is strong, and the drawdown level is acceptable in my opinion for achieving this, being aware of these historical fluctuations is key.

The historical and recent evidence gives me confidence that the system will likely recover from future dips and continue to reach new profit highs.

This rationale, based on thorough data assessment, is fundamental to building a robust betting portfolio.

From April 2023 to the present day, the graph shows another immediate drop-off, followed by nine distinct dips that would have required weathering before the balance increased.

Additionally, there were approximately four or five extended periods of no growth or breaking even over several months, before the system reached the recorded +410 points profit with the maximum drawdown remaining at -35 across the entire timeline.

While the headline statistics show healthy returns with a relatively small drawdown for the points gained, it's crucial to consider the detailed performance patterns I've outlined.

When creating systems, I delve much deeper into the filters, constantly seeking improvements.

However, when evaluating a system for portfolio inclusion, I always prioritize analysing the performance graph over time and examining the CARDS history for recent betting activity.

This provides a more nuanced understanding of how the system might feel to follow over the long term.

All this information is available for your use. My aim is to guide you on how to interpret it and emphasize the importance of being well-informed when operating any betting system, whether it's one you've created or one we provide.

Now that we've taken an in-depth look at "HP BACK 4DAYS" as an example, we can move on to briefer overviews of the remaining systems, followed by potential portfolio combinations with adjusted staking.

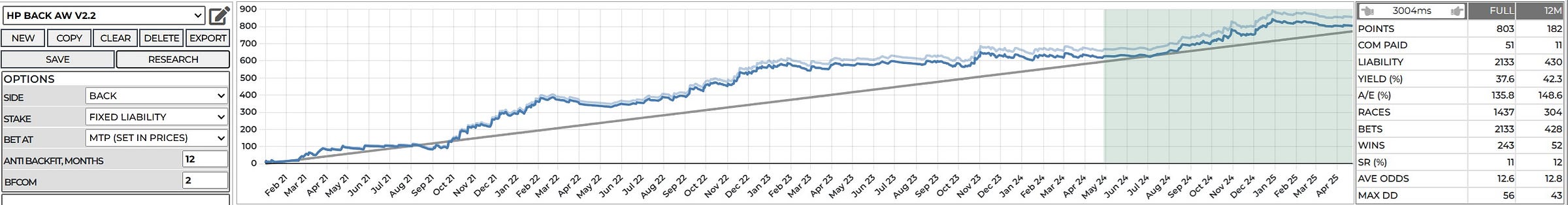

HP BACK AW V2.2

This backing system, a result of Alan's initial design refined by myself, operates exclusively on All Weather racing surfaces.

It employs a robust set of standard filters, with a particular emphasis on trainer percentage of rivals beaten and a specific range of jockey performance based on a 12-week rolling average.

While the system's highest recorded drawdown of -56 points hasn't been seen since 2022, the performance graph reveals a pattern of distinct growth periods interspersed with extended phases of break-even betting across numerous months. This characteristic necessitates patience from users.

This patience, however, is anticipated to be rewarded by the impressive returns achieved over the 52-month recording period, totalling +803 points profit. Encouragingly, the highest drawdown has not occurred within the past twelve months.

The system's average annual points return stands at 185.31, and our current performance over the last 12 months is tracking closely at 182 points, indicating it's currently performing as expected.

However, the betting history suggests we might be entering another prolonged phase of wins and losses that could result in a break-even period lasting several months.

While the exact timing of a shift in this pattern is unpredictable, the data indicates that roughly October to December tend to be the most profitable betting periods for this system.

Members could even explore restricting betting to these months via the filters to see potential outcomes – a point worth considering.

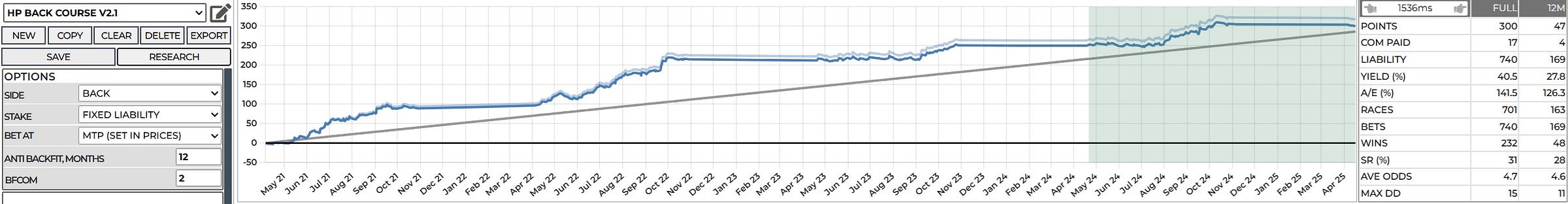

HP BACK COURSE V2.1

This system has evolved from an initial design by Alan, which targeted very high odds with correspondingly high returns and drawdown. My modification aimed to retain similar filter principles but achieve results with a significantly lower drawdown.

The core of this system focuses on specific racecourses, operating exclusively on turf six days a week (excluding Sunday). It combines targeted filters with a narrow focus on the favourite and second favourite in the betting market, assessed just one minute before post time.

I'm particularly fond of the long-term profit potential of this system, alongside its strike rate and the average odds at which the reported returns are achieved.

It's worth noting that the system has distinct periods of inactivity where no qualifying bets are found, typically from November to April.

Betting activity then resumes from May to October. Each of the recorded betting periods has demonstrated varying levels of performance, but all have ultimately resulted in a profit.

The average annual recorded points profit for this system is +69.23. At the time of this snapshot, we are slightly below this figure, but we are on the cusp of entering its active betting phase, which needs to be considered in the overall assessment.

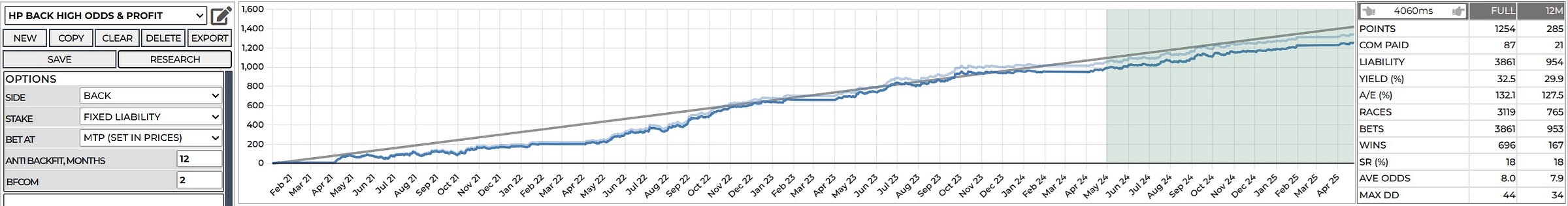

HP BACK HIGH ODDS & PROFIT

As the name clearly indicates, this system operates within a higher odds range, aiming for significant profits by backing horses that meet specific criteria.

This is another hybrid creation from Alan and myself, and I'd consider it a "luxury" addition to a betting portfolio, meaning its aiming for the bigger wins and glory days after longer losing periods.

For its odds range (3.95 to 12), the system boasts a commendable strike rate. The overall drawdown is also impressively low relative to the points gained.

However, a quick review of the performance timeline reveals approximately 15 noticeable drop-off points and six or seven longer periods of break-even betting with no profit.

If you're comfortable with this inherent volatility, the long-term rewards appear exceptional. The statistics show that the lowest recorded drawdown of -44 points occurred outside the past 12 months, which is always a positive sign.

The system analyses the betting market 10 minutes before post time, focusing on horses ranked within the top 1 to 6 according to their odds. Given the specified odds range, this can sometimes lead to multiple selections in a single race.

To illustrate, in a race where different systems are placing bets, "HP BACK HIGH ODDS & PROFIT" might identify two qualifying horses at higher odds.

A win from either could significantly boost the daily or even overall profit. Conversely, if these higher-odds selections don't win, especially over several races in a day, it can be frustrating when viewed on a race-by-race basis.

However, when considering the bigger picture, this system is playing for value bet results.

Over time, it has demonstrated substantial potential and profitability. While including it might occasionally disrupt the smooth progress of more consistent systems on a day-to-day basis, its long-term impact on overall profits, as a "luxury item," is significant.

Despite the inherent higher-odds approach, the system has recorded a very low drawdown of just -44 points for an impressive +1254 points profit over the 52-month betting period.

While there have been periods of lower performance, the long-term rewards, in my assessment, justify its inclusion.

Our current performance aligns closely with the 52-month average annual profit of 289.38 points, with a recorded +285 points at this time. Furthermore, the drawdown over the past year has been lower than previously recorded.

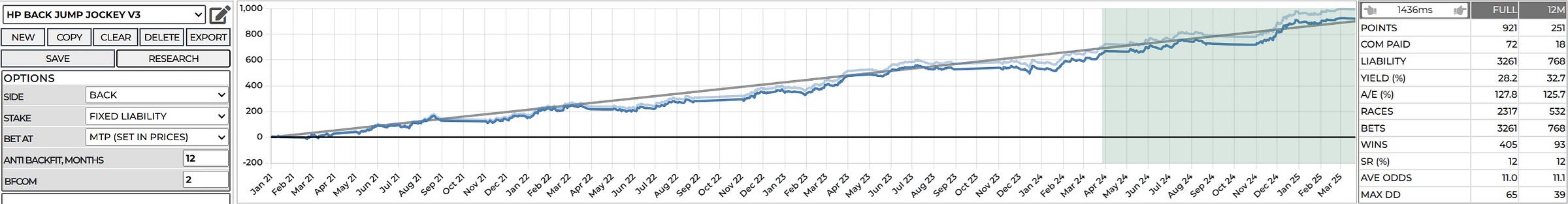

HP BACK JUMP JOCKEY V3

As with the previous "luxury item" system, please bear in mind the principles of performance assessment we've discussed also apply here.

This system offers the potential for significant long-term profits, currently standing at an impressive +921 points over the 52-month betting period, with a very manageable maximum drawdown of -65 points.

We are currently performing strongly, exceeding the annual average points profit of 212.54 with a recorded profit of +251.

While the headline figures look promising, a closer look at the performance timeline reveals at least six instances where the drawdown has either reached or approached its maximum. Given the system's low strike rate of just 12% and its focus on higher-odds horses (average odds of 11), users should anticipate longer periods of losing bets.

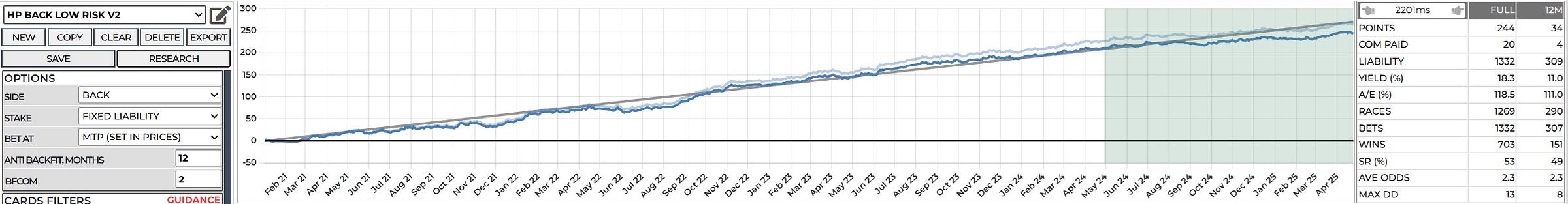

HP BACK LOW RISK V2

This Version 2 system, another collaborative effort between Alan and myself, strategically targets specific racecourses focusing on Class 4 races throughout the day.

Its "low risk" designation stems from its focus on lower-priced horses, evidenced by an average recorded odds of 2.3 and a strong historical strike rate of 53%.

However, the system has experienced a performance dip over the past twelve months, with a return of +34 points, falling below the average annual return of +56.31 points.

Despite this, it's still a respectable points gain for a low-odds backing system over a year. A positive aspect is that the drawdown during this recent period has been lower than its historical performance.

The performance timeline reveals extended periods where the system's profit line dips below the line of best fit before recovering.

The initial year of betting shows a similar outcome to the past twelve months, followed by a period of steady growth from October 2022 to September 2024.

Based on historical data, we appear to be in a phase reminiscent of the first couple of years, which weren't the most profitable. The coming year will be crucial in determining the longer-term trend.

I view this as a consistently active system, but one that warrants monitoring. We might be on the verge of a positive trend reversal and renewed growth, or we could be entering another period of less straightforward profit generation, similar to its early performance.

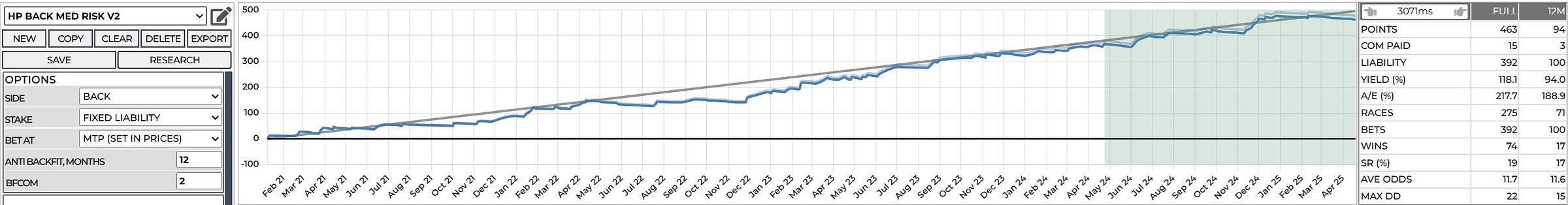

HP BACK MED RISK V2

This is another hybrid system developed by Alan and myself, focusing on individual race meetings and operating within a higher odds range. I would categorize this as another "luxury item" strategy.

It's important to note that this system has a relatively low bet volume. While it produces a very high yield considering the profit achieved, the lower number of bets means the system is more selective and less active, and in my opinion, not as extensively tested over the timeline.

Despite the limited betting activity, the system has achieved a profit of +463 points over the 52-month period, with a remarkably low maximum drawdown of just -22 points.

The average annual points profit is 106.85, and our current performance over the past 12 months is close to this at +94 points.

Encouragingly, the highest drawdown has not been recorded in the last year; in fact, the drawdown for the current twelve-month betting period is only -15 points.

While I find the system appealing, I would prefer to see a significantly higher volume of bets before forming a definitive long-term assessment.

It's crucial to recognize that its profitability is heavily reliant on occasional significant wins following potentially extended periods of losing bets, which is an important factor to consider for your portfolio's overall dynamics.

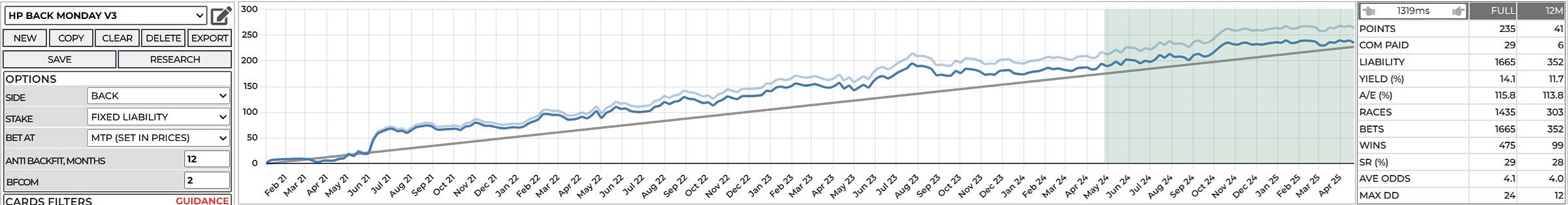

HP BACK MONDAY V3

Unsurprisingly, this is a backing system that operates specifically on Mondays. It targets a defined odds range between 3.55 and 4.6, focusing exclusively on the top two horses in the betting market precisely three minutes before post time.

This system originated from my exploration of scoring jockey performance in conjunction with specific odds ranges, applied to particular days of the week.

The performance timeline shows considerable fluctuation, but encouragingly, the profit line predominantly stays above the line of best fit.

While experiencing the natural ups and downs of betting over the years, the system demonstrates a good level of consistency and operates with a very low drawdown, having achieved +235 points profit over the 52-month period.

The past year has again shown a lower drawdown compared to previous performance. The current profit for this period is +41 points, which isn't significantly below the average annual profit of 54.23 points.

Overall, considering the low drawdown, the current performance is quite positive.

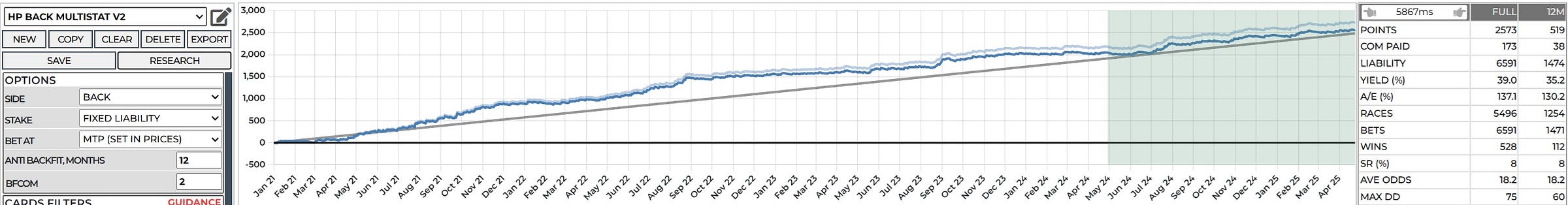

HP BACK MULTISTAT V3

This is another hybrid backing system from Alan and myself, and it's an unapologetically bold strategy that aims for high-odds selections with the clear intention of securing significant wins.

It's a high-risk, high-reward approach, characterized by a substantial drawdown and a low strike rate.

However, over the past 52 months, it has delivered a very high profit of +2573 points, with a further +519 points in the last 12 months.

The current performance is in line with the annual average profit of 593.77 points.

It's crucial to understand that the low strike rate and focus on high odds (average odds of 18.2 decimal) will inevitably lead to extended periods of losing bets and a higher overall drawdown.

If you are comfortable with this inherent volatility, the strategy boasts a strong historical track record of impressive results.

Encouragingly, the drawdown over the past year has remained below its highest recorded level.

While it may lead to frustrating losing days, the winning periods can provide a significant boost to your overall profit. This system is designed for those seeking potentially large gains and are prepared to weather the associated fluctuations.

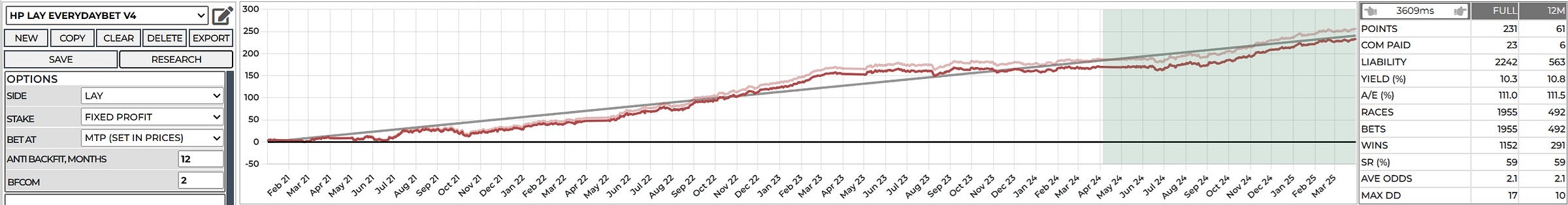

HP LAY EVERYDAY BET V4

This is one of my lay betting systems that targets the top of the betting market, specifically the favourite at odds between 1.82 and 2.46, one minute before post time.

It incorporates a diverse set of filters, with a strong emphasis on the performance of the horse, jockey, and trainer.

As expected for a system laying the favourite, the performance timeline generally trends below the line of best fit. However, the carefully designed filters aim to consistently generate a profit over time.

The system has recorded +231 points profit over 52 months of betting, resulting in an average annual return of 53.31 points.

Over the past year, we are slightly ahead of this average with a profit of +61 points and a very low drawdown of just -10 points, which is also less than previously recorded.

The high betting volume is a notable characteristic, with 492 races covered in the past year – averaging more than one bet per day. Therefore, users should be prepared to oppose the favourite in one or more races on most days.

The current strike rate of 59% provides a crucial edge given the low odds betting, even after accounting for Betfair commission.

The performance graph suggests we are currently in a growth phase, potentially extending until July or August.

However, the actual betting outcomes over time will ultimately determine the trajectory.

HP LAY JUMP JOCKEY V3

As the name suggests, this is a lay betting system focused on jump racing, specifically targeting higher-priced horses considered to have a lower probability of winning, but which inherently carry greater financial liability when laying. This is another collaborative system from Alan and myself.

Considering that this system involves placing high-odds lay bets with a fixed profit target (meaning the odds dictate the risk), the recorded drawdown over both the 52-month period and the past twelve months is remarkably low.

The average odds at which lays are placed is 11.5. While this means a series of losing lays could potentially push the drawdown beyond its historical maximum, the results to date show this hasn't occurred, supported by a very high strike rate of 95%.

This robust strike rate, coupled with a profit of +328 points over 52 months (exceeding the average annual expectation of 75.69, with the current twelve-month figure at +93), presents a compelling picture.

However, it's crucial to remember that laying at high odds exposes your betting bank to a greater potential loss per bet. This system operates within an odds range of 6.4 to 21.

If you are comfortable with this level of risk per bet and are seeking a system with a very high strike rate, the strong results and overall performance of "HP LAY JUMP JOCKEY V3" suggest it could be a suitable choice.

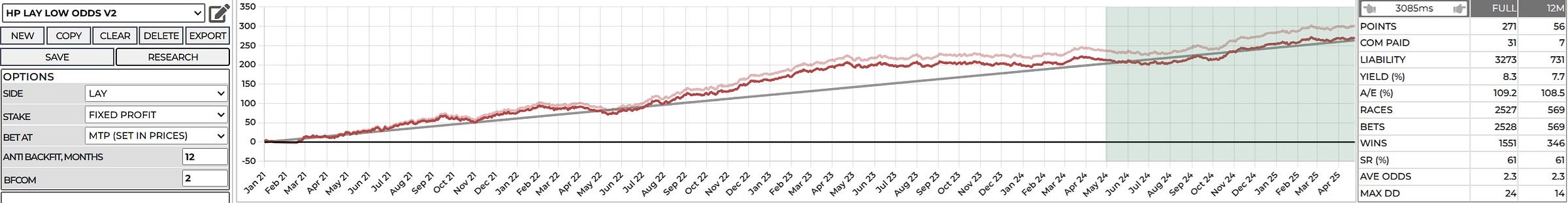

HP LAY LOW ODDS V2

This is another collaborative effort with Alan, designed to be a lower-risk lay betting system compared to the previous high-odds lay strategy. It operates with an average lay odds of 2.3, targeting the favourite between 1.99 and 2.58 odds one minute before post time.

In this regard, it shares similarities with the "HP LAY EVERYDAY BET V4" system, and on some days, it might even identify the same horse to lay. However, the underlying filters are distinct, preventing identical bets across both systems consistently. If avoiding duplicate lay bets is a priority, members can choose one system or the other, or utilize the "Kill Opposites" feature within the Auto Bet options.

Performance-wise, this system has been very good, consistently trending above the line of best fit, which is a positive indicator. Achieving +271 points profit by opposing the favourite over 52 months of betting is a strong result. The current profit over the past year stands at +56 points, which is just slightly below the annual expected average of 62.94 points – a negligible difference.

The drawdown for this system is also excellent, at just 24 points overall, and the maximum loss experienced in the past year is lower than the previously recorded maximum.

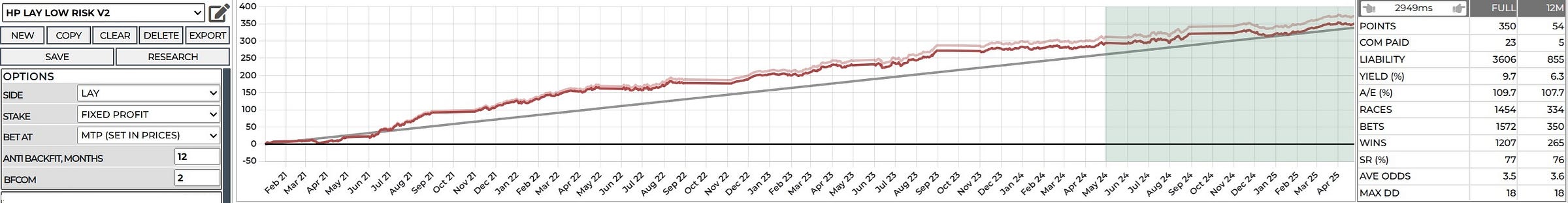

HP LAY LOW RISK V2

This system, another collaborative design from Alan and myself, operates with a slightly higher lay odds range of 2.28 to 5.4. Unlike some other systems, it doesn't specify a horse's rank, meaning multiple horses in a single race could qualify if they meet all the criteria.

Incorporating course, class, and annual settings, among others, this system still manages to generate a respectable volume of lay bets throughout most of the year.

It boasts a decent strike rate for a lay system at these odds and a very low maximum drawdown of just -18 points.

Interestingly, the highest drawdown for this system was recorded within the past twelve months. Currently, the system shows a profit of +54 points for this period. However, this is below the annual predicted average of 80.77 points at the time of recording.

This discrepancy could indicate that we are on the verge of a positive trend reversal, leading to renewed growth, or it might suggest a further dip before a significant upward trend emerges, as seen previously on the performance graph. Time will tell which scenario unfolds.

I am encouraged by the profit line generally trending above the line of best fit and the appealing average lay odds of 3.5, which have contributed to a +350 points return over the 52-month period.

While the performance history shows alternating months of wins and losses without any major drop-off points, suggesting good consistency, the recent twelve-month performance is a point of caution. It raises the question of whether this is a precursor to a more significant downturn or simply a temporary dip before a return to stronger form. This recent performance is definitely something to monitor.

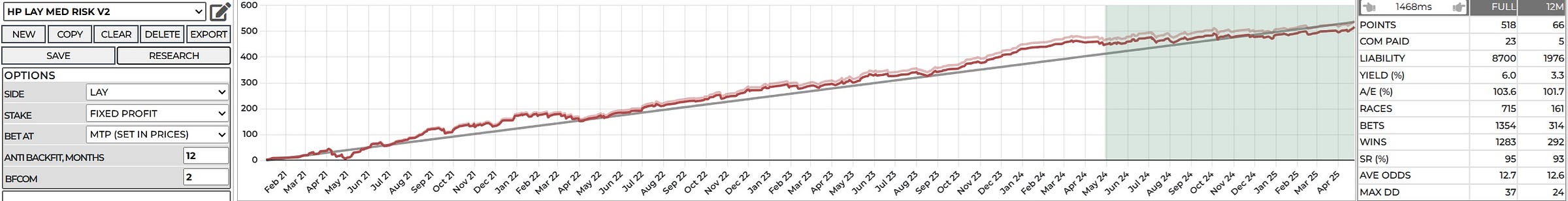

HP LAY MED RISK V2

Developed from one of the original 14 systems through collaboration between Alan and myself, this system increases the potential liability per bet, with an average recorded lay odds of 12.7.

It's important to be comfortable with this level of liability, as the system aims for a fixed profit, meaning your potential exposure is directly influenced by the lay odds.

The system targets horses within the top 2 of the betting market, with an actual odds range of 7.8 to 21, in races with field sizes between 7 and 14 runners.

While there are more intricate filters in play, fundamentally, this is a high-odds lay system with a high strike rate (similar to others we've discussed), but it will identify a distinct set of horses to lay. It also operates with a strong historical strike rate of 95%.

The maximum recorded drawdown is -37 points, and the drawdown over the past year has been lower than this. However, with an annual average profit of 119.54 points, the current twelve-month profit of +66 points is significantly below this expectation.

The performance timeline shows considerable fluctuation with periods of strong growth, and the majority of bets are wins. However, as with similar high-liability lay systems, it's crucial to be prepared for the fact that a few losing bets could significantly impact a month's profitability, even if the long-term potential is strong.

I believe this system offers value and is well-designed for this particular betting approach. However, the recent drop-off in points over the past year is a point of concern that warrants monitoring in the coming months.

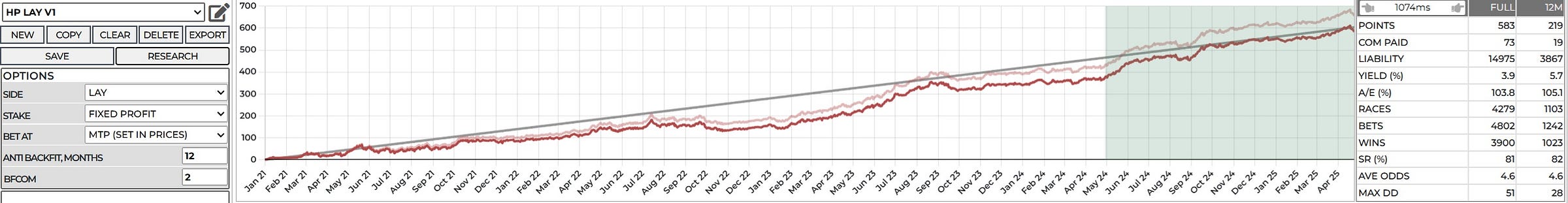

HP LAY V1

This is one of my newer systems, characterized by its straightforward setup with just a select few filters in operation.

It targets the top 3 horses in the betting market at odds between 4.3 and 4.9, assessed three minutes before post time.

Despite its simplicity, the system is remarkably active, covering over 1103 races and placing 1242 bets in the past twelve months – averaging a few bets per day, and sometimes more than one in the same race.

The current recorded profit of 583 points over 52 months translates to an average expected annual profit of 134.54 points. Encouragingly, the system has outperformed this average in the past twelve months, recording a profit of +219 points.

However, it's important to note the overall maximum drawdown of -51 points, and the performance timeline reveals periods of significant fluctuation. There have been instances where the balance has dropped considerably and taken around a year to recover and continue its upward trend. This historical volatility should be taken into account.

The past year's results have been strong, and the drawdown during this period is much lower than previously recorded. Nevertheless, the system's history of greater volatility is a factor to consider when deciding whether to include it in your portfolio.

Personally, I am comfortable with this level of volatility given the potential for significant gains. The recent strong performance and the high volume of betting data provide increased confidence in its long-term viability. However, as with any system, it's essential to align it with your individual portfolio goals and risk tolerance.

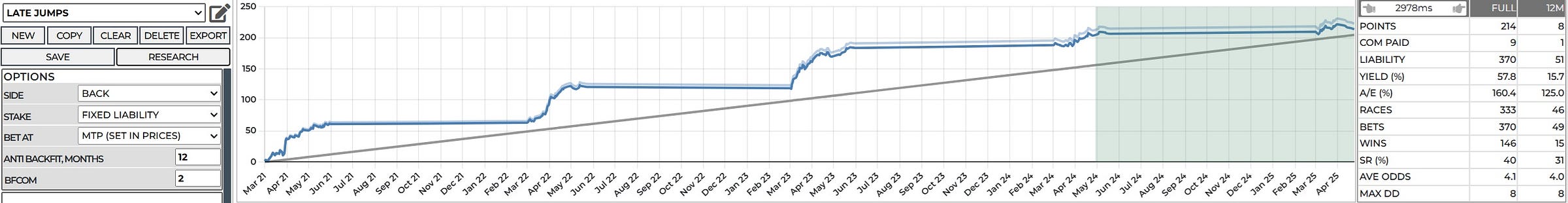

LATE JUMPS

We've reached the final system in our initial overview of the 17 new additions! This one, developed by Alan, is particularly interesting due to its clearly defined operating period: jump racing over three months of the year – March, April, and May.

It has recorded a very respectable total points profit of +214 with an exceptionally low maximum drawdown of just -8 points. While this highest drawdown occurred within the past twelve months, I wouldn't place too much significance on this given the system's short, focused betting periods and the relatively small drawdown figure.

"LATE JUMPS" is a back betting system that targets an odds range between 3.5 and 4.6 and boasts a very decent overall strike rate of 40%.

The average annual return for this system is 49.38 points. At the time of this assessment, we are currently below this target. However, with approximately two-thirds of its active betting cycle (March, April, May) completed, and the month of May still to come, the final outcome for this year remains uncertain. The performance graph offers hope that May could be a particularly strong month for this system if historical trends continue.

Concise System Snapshot: Navigating Your Options

Hopefully, the preceding detailed breakdowns have provided you with a much clearer understanding of each of the 17 free example betting systems, offering insights into their performance, potential, and my personal perspective on their characteristics.

To provide a quick reference, here's a summarized snapshot of each system's key attributes to help you navigate your choices:

COPPER 2WEEKS: Cyclical growth pattern, lower bet volume, higher strike rate, low drawdown. A selective system for consistent gains.

HP BACK 4DAYS: Backing on specific days, moderate annual profit, manageable drawdown. Requires patience through periods of fluctuation.

HP BACK AW V2.2: All-Weather focus, strong long-term profit, periods of break-even betting. Patience is key for long-term rewards.

HP BACK COURSE V2.1: Specific course focus (Turf), good long-term profit and strike rate, seasonal activity. Profitability tied to specific months.

HP BACK HIGH ODDS & PROFIT: Higher odds backing, significant long-term profit, moderate drawdown, periods of volatility. High reward potential with inherent ups and downs.

HP BACK JUMP JOCKEY V3: Higher odds backing (Jumps), strong long-term profit, acceptable drawdown, lower strike rate. Requires tolerance for longer losing runs.

HP BACK LOW RISK V2: Lower odds backing (Class 4), consistent activity, moderate annual profit, lower recent performance. Active but current trend warrants monitoring.

HP BACK MED RISK V2: Higher odds backing (specific meetings), lower bet volume, high yield, low drawdown. Relies on less frequent but significant wins.

HP BACK MONDAY V3: Monday backing (specific odds), consistent performance, very low drawdown. Reliable with steady, albeit moderate, gains.

HP BACK MULTISTAT V3: High odds backing, very high long-term profit, higher drawdown, low strike rate. Significant potential but with considerable volatility.

HP LAY EVERYDAY BET V4: Laying the favourite (low odds), high bet volume, consistent profit, very low drawdown. Active system with a steady edge.

HP LAY JUMP JOCKEY V3: Laying higher odds (Jumps), strong profit, very low drawdown, high strike rate. High strike rate but greater liability per bet.

HP LAY LOW ODDS V2: Laying the favourite (low odds), good profit, very low drawdown. Consistent and lower-risk approach to laying.

HP LAY LOW RISK V2: Laying (moderate odds), decent bet volume, low drawdown, recent performance dip. Consistent but recent trend needs observation.

HP LAY MED RISK V2: Laying higher odds, significant liability, high strike rate, recent performance lag. High potential but requires comfort with liability.

HP LAY V1: Laying (specific odds), high bet volume, strong profit, moderate drawdown, historically volatile. Potentially high reward but with periods of fluctuation.

LATE JUMPS: Seasonal backing (Jumps), good profit, very low drawdown, lower recent performance within season. Short, focused betting periods with promising history.

Ultimately, a well-informed bettor is an empowered bettor. You don't want to be debating the menu while the house is on fire. Take the time to understand these systems, align them with your risk profile and goals, and you'll be much better equipped to navigate the betting landscape.

Not a Hedger Pro member yet? Discover the edge at www.hedgerpro.co.uk

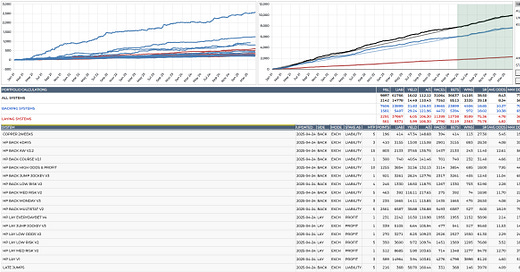

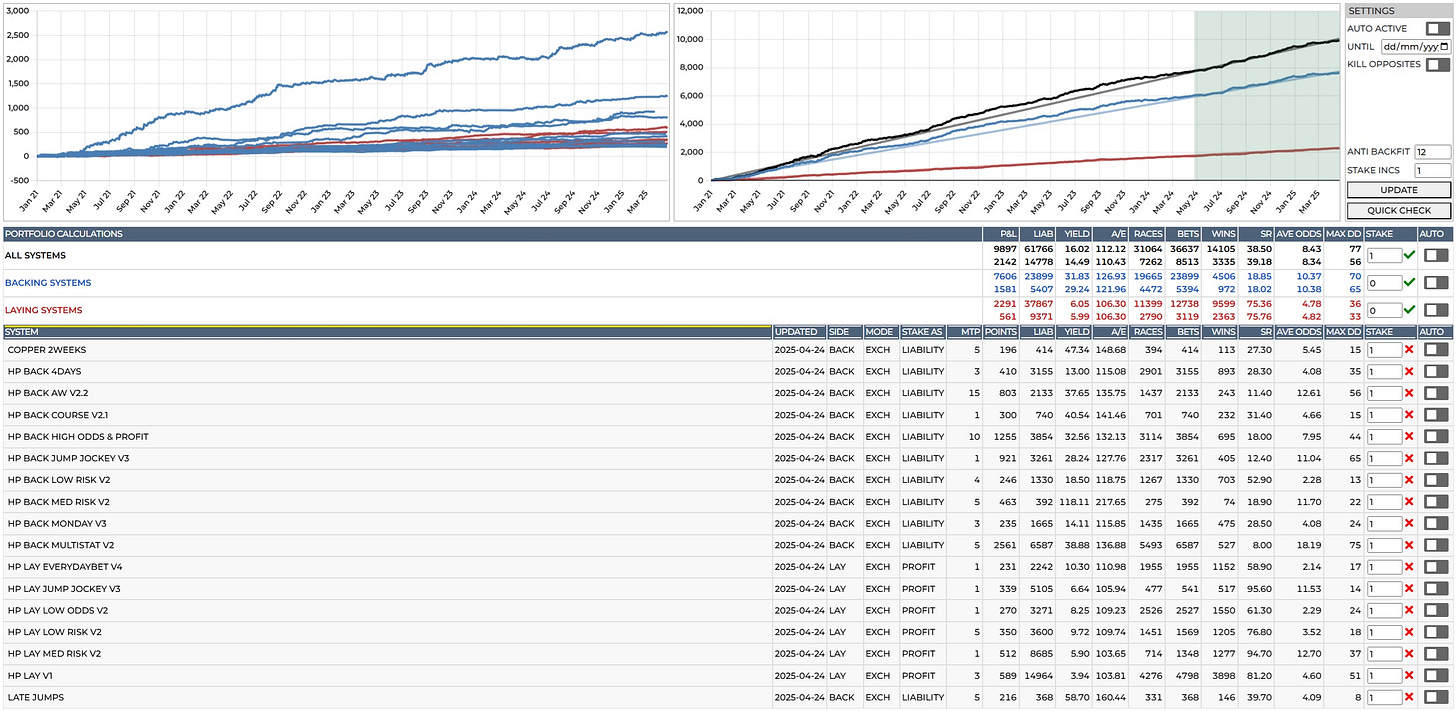

Analysing the Power of the Portfolio: Running All 17 Systems Concurrently

Let's now examine the collective performance of all 17 Version 2 systems running simultaneously over the past four years. By utilizing Hedger Pro's "Anti Back Fit" tool, we can analyse performance across different recent timeframes (12, 6, 3, and 1 month) to gain a deeper understanding of the portfolio's dynamics. The "Anti Back Fit" statistics provide crucial figures, including the all-important Drawdown for these periods.

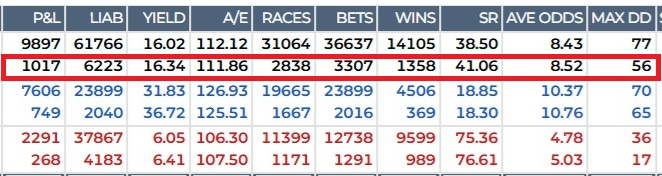

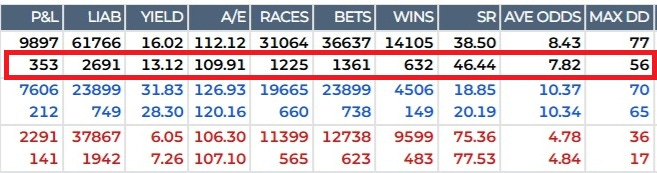

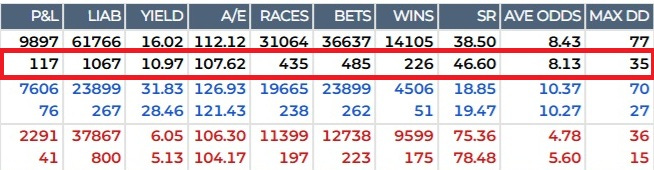

The overall growth chart, illustrating the combined performance from January 2021 up to yesterday's betting on April 23rd, 2025, shows a positive upward trend when looking at the entire period with the Anti Back Fit set to 12 months.

Zooming in on the performance over the past twelve months (indicated by the red box in the accompanying image), we can assess the recent consistency of the combined systems. These figures, determined by the Anti Back Fit regions, are invaluable for discerning whether a system's recent performance aligns with its historical trends or appears to be an anomaly. In this instance, the Profit & Loss (P&L) over the last year demonstrates a better-than-average performance compared to the entire four-year timeline. The number of races, wins, and strike rate all appear healthy, the average odds are within the desired range, and notably, the drawdown has not reached its maximum historical peak within this 12-month window – a positive sign.

Further analysis of the past six months reveals an overall performance consistent with the broader 12-month view. However, this more recent timeframe indicates that the highest drawdown point within the entire historical data actually occurred within these last six months.

Drilling down to the past three months begins to show a slight deceleration in the overall P&L, although the profit of 353 points remains respectable. All other metrics align with the gradual narrowing of the timeframe from the 12-month view.

Interestingly, the highest drawdown experienced over the past year also occurred within this recent three-month period. This highlights how short-term volatility can be masked when looking at longer periods. Someone starting to bet within the last three months would have had to navigate a maximum drawdown of -56 points.

Finally, examining just the past month's betting activity for the entire portfolio shows figures that are proportionally consistent with the 12, 6, and 3-month analyses. The numbers align with what one would expect for a month's activity when compared to the longer-term trends.

Turning our attention to the drawdown figures, the highest drawdown period over the past year occurred approximately two to three months ago, with the most recent 30-day data showing a peak drawdown of -35 points. Considering the total P&L, liability, yield, and betting activity, alongside decent average odds for both backs and lays and a solid strike rate, this level is acceptable.

However, these statistics wouldn't necessarily inspire extreme confidence for someone starting with a very small 100-point betting bank, based on either the recent month's data or the entire historical performance. (I will elaborate on bankroll management in a future post.) Nevertheless, the combined performance across a significant amount of race data and 17 diverse strategies demonstrates the potential that exists with a well-managed betting bank capable of accommodating periods of balance reduction.

I will record a brief video shortly to visually demonstrate how I conducted this data analysis within Hedger Pro to obtain this portfolio-level view across the various timeframes. This should be a valuable resource for members looking to create and combine their own portfolios of betting systems.

Now, while we're on the topic of portfolio construction, let's explore potential combinations of betting systems with different staking methods. While there are various approaches to achieve similar objectives, here's one example with its underlying rationale:

A More Conservative Path: Prioritizing Consistency and Lower Risk

For those who find prolonged losing streaks challenging, regardless of overall profit potential, and who prefer to avoid the volatility of high-odds betting, a portfolio focused on more regular wins and lower risk is a sensible approach. By clearly defining your preferences, you can strategically select accessible, entry-level systems that align with your comfort level.

Let's use the example systems to illustrate this, combining a selection that prioritizes key metrics such as low drawdown, lower average odds, and higher yield and strike rate. This strategy is likely to appeal to a broader range of bettors, as many find the longer losing periods associated with high-odds systems difficult to endure. This approach isn't for everyone, but Hedger Pro provides the tools to filter and create your own ideal setup to operate in this manner.

In the following example, I'll apply specific criteria to demonstrate this concept:

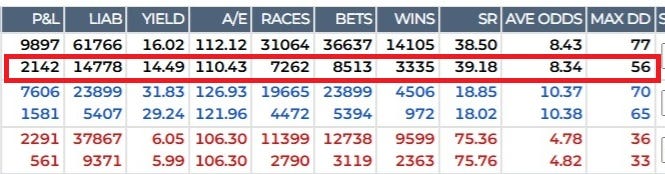

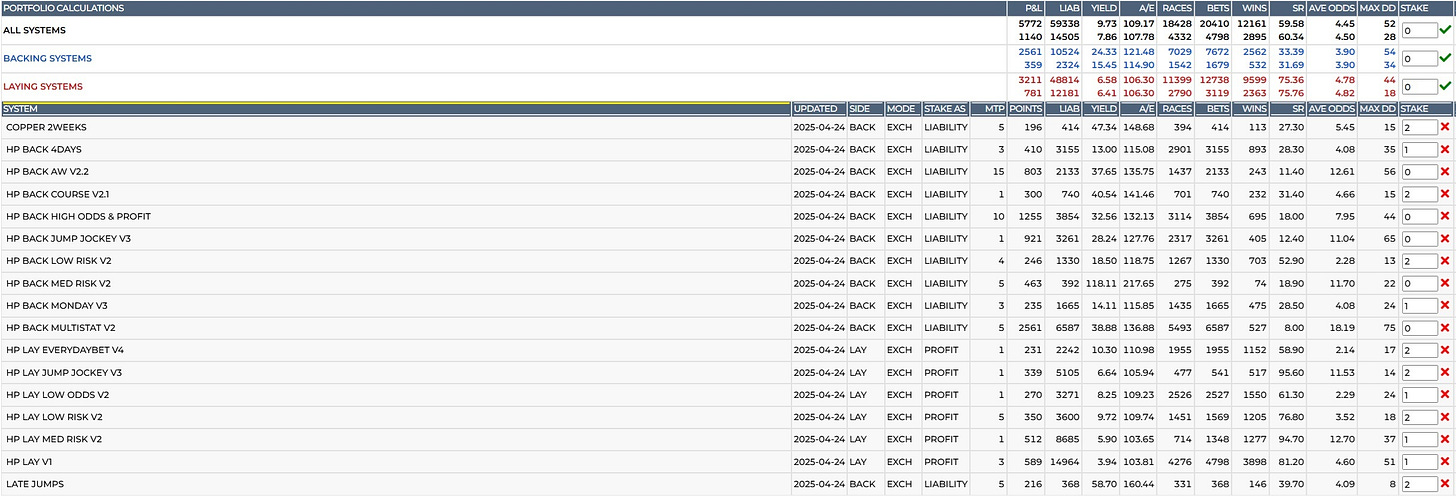

High Strike Rate, Low Drawdown with Weighted Staking

In the setup above, I've selected 12 of the 17 betting systems based on having a strike rate of 20% or higher. I then applied a weighted staking approach, doubling the stake on systems with a drawdown of 20 points or less.

This selective combination results in a significantly lower overall drawdown compared to running all 17 systems concurrently (-52 points versus -77), and also improves the annual drawdown figures for both backing and laying.

The key areas of improvement are evident in the enhanced strike rate of 59.58% compared to 38.50%. Interestingly, the total liability for this selection of 12 systems (£59,338) is very close to that of running all 17 (£61,766). This suggests we are potentially achieving more favourable returns with a similar level of capital at risk, leading to a less stressful overall betting experience.

While the total points profit is naturally lower with this more conservative approach (£5772 compared to £9897), it's a perfectly acceptable trade-off for a significantly better strike rate and reduced overall risk, especially considering these returns were achieved with just £1 and £2 stakes over the entire timeline.

Ultimately, the decision of how to build your portfolio rests with you. Always keep in mind that Drawdown and P&L figures represent actual monetary values. They are only referred to as "points" when using a £1 stake.

(Looking at the clock, I realize this has been a very extensive post. If you've made it this far, thank you for your dedication!)

I'm going to wrap things up here for today as it's time to cook dinner (6:30 PM here in the UK). If you have any questions, please don't hesitate to leave a comment below or send me an email at ryan@hedgerpro.co.uk, and I'll get back to you as soon as possible.

Not a Hedger Pro member yet? Discover the edge at www.hedgerpro.co.uk

Kindest Regards,

Ryan

thanks very much for that ryan , very interesting and it must have took you a long time to do that .